Explain the Main Differences Between Regressive and Progressive Tax Systems.

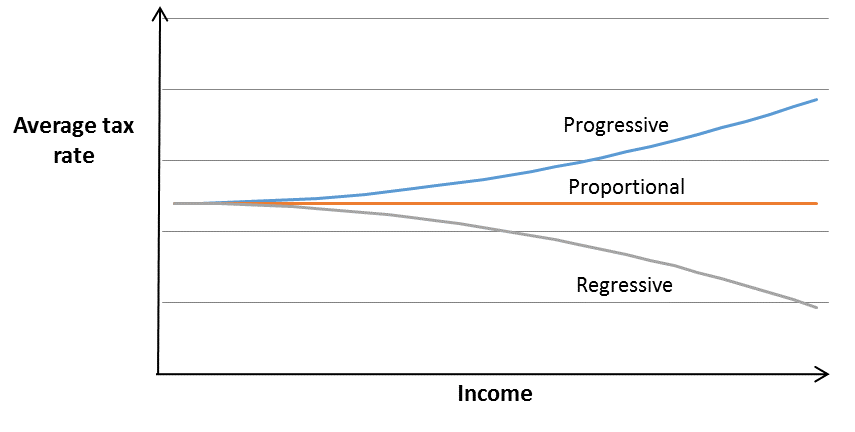

A the current federal personal income tax system b a local 25 income tax and c the current FICA social security tax system. A flat-tax systems is where the same tax rate is applied to everyone.

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

In contrast to it regressive tax system is the arrangement where the tax to be paid is uniform in nature.

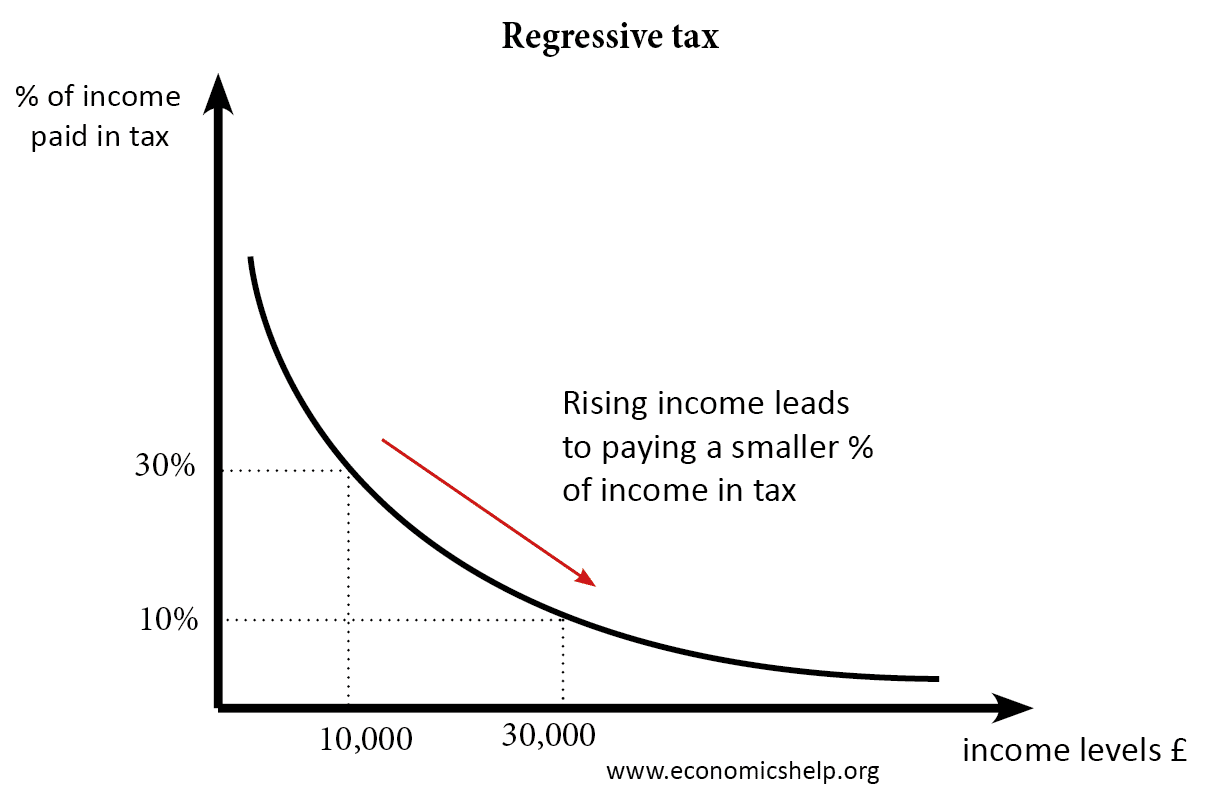

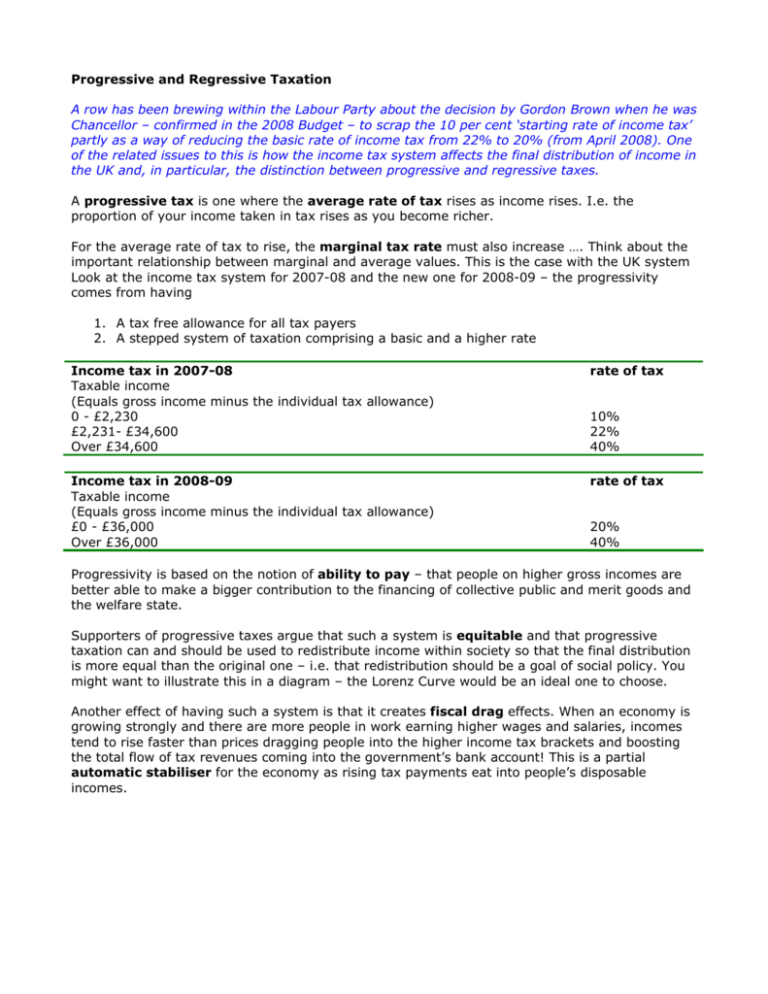

. A regressive tax system is where the lower class of people pay a bigger portion of income tax than the higher class. As against this in the case of a regressive tax. 3 Describe the differences between a regressive and progressive tax.

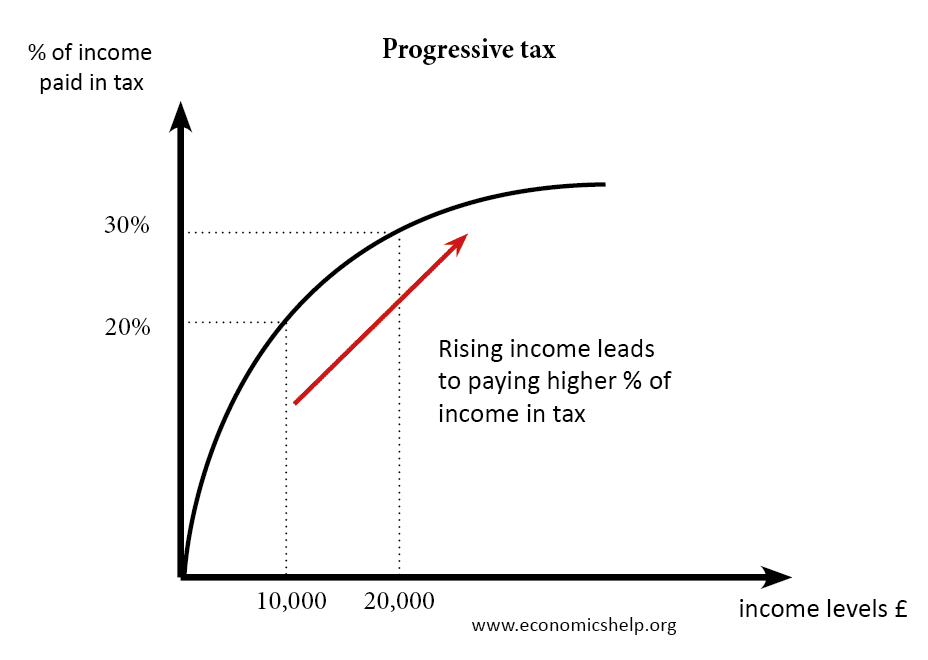

Most income tax schemes are progressive because they usually rely on graduated rates which increase the. A regressive tax system is where the lower class of people pay a bigger portion of income tax than higher class. What is the difference between regressive and progressive taxes.

Progressive taxes require those with higher incomes to pay a higher percentage of their income on those particular taxes. Unlike regressive tax wherein the tax payers level of income does not matter at all. Provide some examples of each in Canada.

A progressive tax system would have the most stabilizing effect of the three tax systems and the regressive tax would have the least built-in stability. Most state income taxes have a similar progressive structure. Describe the difference between progressive and regressive taxes and give an example of each.

Tax that imposes a higher percentage rate of taxation on low incomes than on high incomes. MO81 Explain the social safety net. How Do You Calculate Progressive Tax.

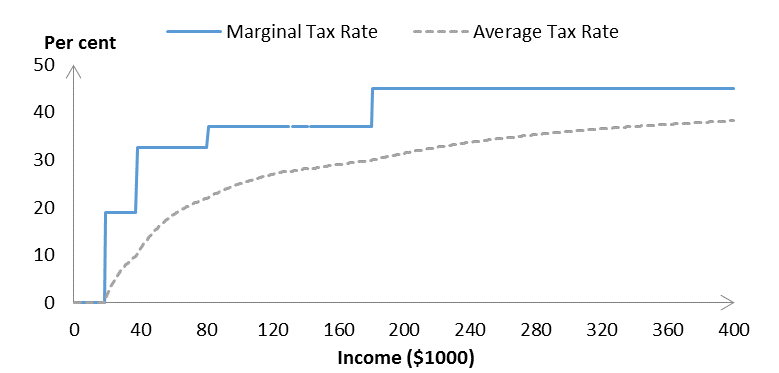

In progressive tax marginal tax rate is greater than the average tax rate. How is Progressive Tax Different from Flat Tax. A progressive tax system is a proportional relationship between your income and taxes.

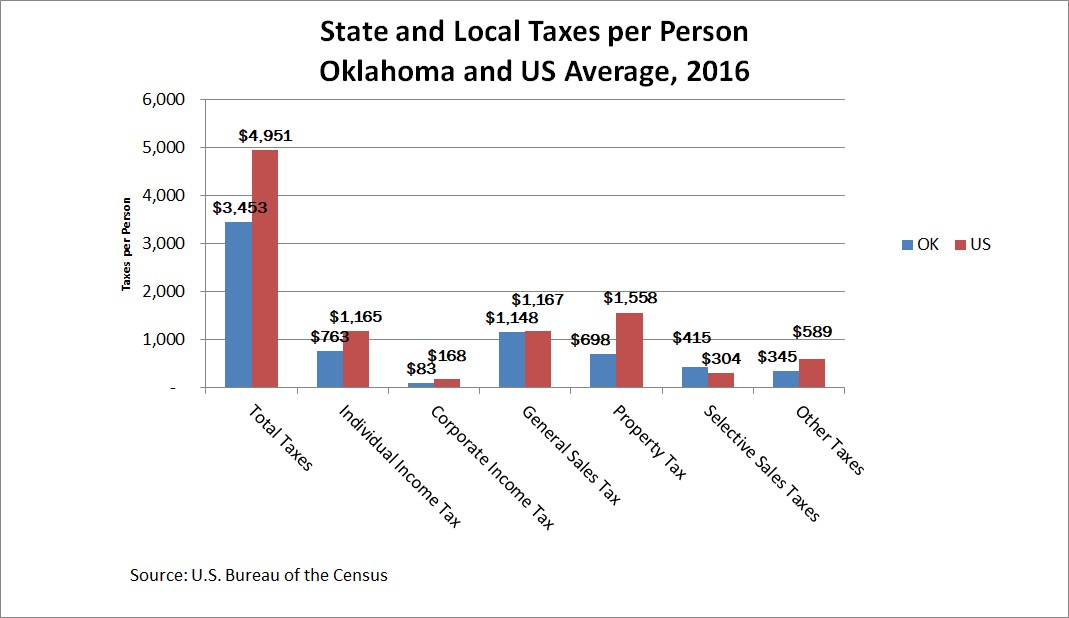

A progressive tax is a type of tax that takes a larger percentage of income from taxpayers as their income rises. Here we have illustrated the major differences between progressive tax and flat tax. Explain the difference between state and local revenue systems.

This follows from the previous paragraph. In this system the rate of tax falls with increase in income. A regressive tax takes a smaller percentage of peoples income the larger their income is.

The main differences between a flat regressive and progressive tax plans is that the flat tax you pay the same amount even if the price of the good increases applies for everybody a regressive tax is the one that decreases if the amount of money you make increases and the progressive tax is when the tax increases if the amount of money you make. Rate of taxation decreases as the taxpayers income increases. A progressive tax system is when your income increases so does your taxes.

A regressive tax system is where the lower class of people pay a bigger portion of income tax than higher classA progressive tax system is when your income increases so does your taxesA flat-tax systems is where the same tax rate is applied to everyone. That role continued until the late 1970s when inflation began to hurt the economy. They require those with lower incomes to pay a higher percentage of their income on such taxes.

List the major types of state local and federal taxes. Regressive taxes are those that are paid regardless of income such as sales taxes sin taxes and property taxes. However the progressive tax vs flat tax debate has continued ever since the two methods of taxation came into existence.

Explain whether you think this is a fair way of funding government programs or not. What is the difference between a progressive tax a proportional tax and a regressive tax. Progressive tax includes all direct taxes while regressive tax covers all indirect taxes.

Both these methods of taxation come with their own pros and cons. The difference between progressive regressive and proportional tax systems lies in how the government assesses a taxpayers tax liability or obligation. An example is the federal income tax where there are six marginal tax brackets ranging from 10 lowest-income taxpayers to 396 highest-income taxpayers.

In progressive tax system the assessees ability to pay is considered. A tax is called Degressive when the rate of progression in taxation does not increase in the same proportion as the income increases. In other words as your income increases so does your tax amount.

An example is state sales tax where everyone pays the same tax rate regardless of their income. Arrow_forward What will happen to the amount of taxes collected by the government during a recession when there is a progressive income tax system. It is a direct tax because the money goes directly to the government.

Also explain what is the dominant way to raise taxes used by the state and the implications for funding of government because of this tax. Tax that imposes a higher percentage rate of taxation on persons with higher incomes. A regressive tax system affects low-income taxpayers more than high-income taxpayers because it takes a higher percentage of their.

Higher-income taxpayers pay a smaller percentage of their income than lower-income taxpayers because the tax is not based on ability to pay. A progressive tax increases at an increasing rate as incomes rise thus having more of a dampening effect on rising incomes and expenditures than would. Decide which of these tax structures is represented by.

Progressive Tax Systems A progressive tax system means the proportion of income paid in taxes increases as the taxpayers income increases. A regressive tax is the exact opposite. A regressive tax does not take into account an individuals income level or ability to pay but it is not exactly the opposite of a progressive tax.

Explain mandatory spending and discretionary spending. Regressive taxes are applied uniformly and they do not change based on an individuals level of income. Government promoted regulation during and after the Great Depression.

Explain the difference between a progressive tax system a regressive tax system and a proportional tax system. The impact of regressive taxes is exactly the opposite. A regressive tax is the exact opposite.

Frequently this is seen when the tax is applied to transactionslike a sales taxand increases the total cost of something. A progressive tax system refers to the tax system where the tax rate to be paid increases with the increase in the income.

Progressive Tax Definition System Rates Vs Regressive Tax

Progressive Tax Economics Help

Brief Progressive And Regressive Taxes Austaxpolicy The Tax And Transfer Policy Blog

How Oklahoma Taxes Compare Oklahoma Policy Institute

What S The Difference Between Progressive And Regressive Taxes Youtube

Tax Systems Progressive Regressive Proportional Economics Lessons Learning Objectives Economics

How Your Taxes Work Regressive Vs Proportional Direct Tax Indirect Tax Gst Economy Hut

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Income Tax Flat Or Progressive Evn Report

What Is Taxation Indirect Tax Direct Tax Tax Rates

Brief Progressive And Regressive Taxes Austaxpolicy The Tax And Transfer Policy Blog

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Difference Between Progressive And Regressive Tax With Comparison Chart Key Differences

Understanding Progressive Regressive And Flat Taxes Turbotax Tax Tips Videos

Comments

Post a Comment